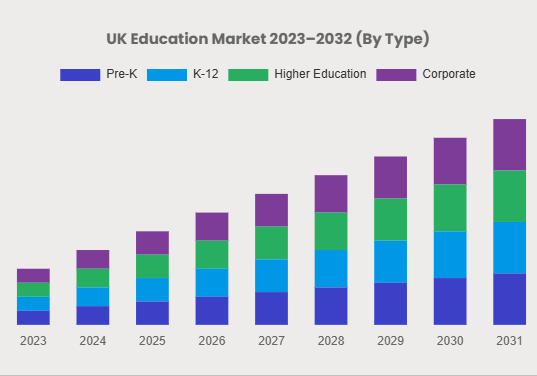

UK Education Market 2024–2033

Reports Description

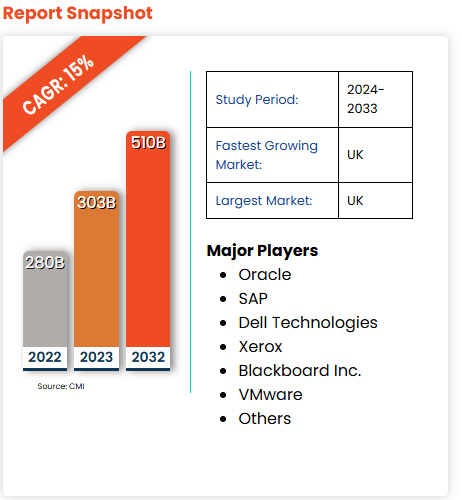

The UK Education Market was estimated at USD 280 billion in 2022 and is anticipated to reach around USD 510 billion by 2032, growing at a CAGR of roughly 15% between 2023 and 2032.

CMI research report offers a 360-degree view of the UK Education market’s drivers and restraints, coupled with the impact they have on demand during the projection period. Also, the report examines global opportunities and competitive analysis for the UK Education market.

︵‿︵‿︵‿︵

Growth Factors

- Early years, primary, secondary, further education and higher education are the five phases of education in the UK. As of July 2023, there were 32,163 schools, colleges, and universities across the UK. It comprises different types of schools, including Independent Schools, Academy Schools, Locally Authority Maintained Schools, and Special Schools. Further, there were over 20,000 Primary Schools across the nation, which children attend from age 4. Also, the country had 4,190 Secondary Schools, with children aged 11 to 16, 9,202 Academy Schools, and 1,341 Multi-Academy Trusts. Also, 2,453 Independent Schools and 1,802 Special Schools were located across the UK.

︵‿︵‿︵‿︵

- A market of employers seeking standardization to a high level of quality in providing the necessary training for its employees has made the education and vocational training sector the main target for consolidation. A chance to further digitize the service offering, streamline internal processes and provide cost-saving efficiency also lends support to this.

︵‿︵‿︵‿︵

- As per the Department of International Trade, the thriving UK education sector exported £23.3 billion in 2018, and the government is working with the industry to increase that amount to £35 billion annually by the end of the decade. These new initiatives include a new Export Academy, financial support, a variety of missions, “meet the buyer” events, and webinars.

︵‿︵‿︵‿︵

- In the UK, there are about 1,000 EdTech companies offering a wide range of innovative, cutting-edge solutions that make it simpler for students to study remotely and have access to creative, interactive learning.

︵‿︵‿︵‿︵

- The UK education budget for 2023–2023 is £99.8 billion. Since the previous budget, additional funding has been granted to schools across the UK, totalling £55 billion.

︵‿︵‿︵‿︵

- During the COVID-19 outbreak, the transition to remote learning was one of the biggest transformations for the industry. All students were informed that they would need to learn remotely and would no longer be required to attend school or university in person, in addition to the working-from-home advice initially provided by the government in March 2020. In addition to being difficult for the kids, this required teachers and university professors to adjust to a different manner of functioning. Students could not establish and grow the personal relationships they would have normally had with their teachers and fellow students if they were in the classroom at their schools and their universities. Because of this, around 70% of college students claim that COVID-19 has negatively impacted them.

︵‿︵‿︵‿︵

COMPARATIVE ANALYSIS OF THE RELATED MARKET

UK Education Market

CAGR 15% (Approx)

CAGR 4.2%

(Approx)

CAGR 20%

(Approx)

US$ 510 billion by 2032

US$ 3.2 Trillion by 2030

USD 324 Billion by 2030

Report Scope

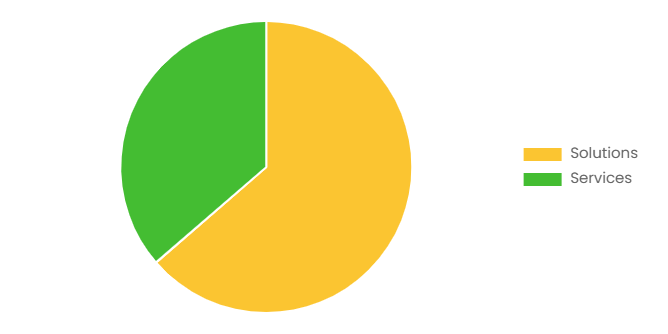

The study’s focus is on UK Education market analysis on a global scale, and market sizing includes the income generated by these solutions provided by different market players. In order to support the market projections and growth rates over the anticipated period of 2024-2033, the study additionally monitors important market factors, underlying growth influencers, and significant vendors active in the sector.

The study also examines how COVID-19 has affected the ecology generally. The scope of the study includes market sizing and forecast for segmentation by component and type.

Key Market Dynamics

- According to The Institute for Fiscal Studies, UK, prior to the epidemic, the UK spent a total of £104 billion on education or 4.4% of its 2019–2020 national revenue (including the likely cost of issuing student loans). This is 8% less than in 2010–2011 when it made up 5.6% of the country’s gross domestic product.

- Prior to the financial crisis, less than 5% of the country’s income was spent on education. In 2019–2020, it would have been £16 billion higher if it had stayed at this level.

- Spending on education increased by 3% in real terms in the most recent year (2020–2022), which is partially attributable to temporary higher levels of assistance during the epidemic.

- In 2020 and 2022, the government increased its £700 million funding for colleges and sixth forms. However, the tremendous increase in student enrollment has undermined much of this. With an additional 10% growth predicted between 2022 and 2024, this growth in student enrollment poses a significant challenge for colleges and sixth forms. The overall amount spent on education for students aged 16 to 18 is anticipated to grow by 6% between 2022–22.

- More than 453,000 students from 225 countries and territories studied at 156 UK institutions in 2019–2020, according to The Scale of UK Higher Education Transnational Education 2019–2020. This represents an increase of about 11% year over year in the year before the outbreak.

- The UK has always been a pioneer in providing transnational education (TNE), which includes cooperative programs that are partially or entirely provided abroad. Its institutions have increased TNE activities in the past few years. The difficulties posed by COVID travel limitations are, unsurprisingly, a driving force behind this growth. The epidemic has highlighted how vital it is to discover means of offering education to a huge audience of pupils who are unable or unwilling to study overseas but interested in credentials from a foreign university. This is true for UK institutions and those in other countries.

- The above-mentioned figures signify that the UK education market is expected to witness significant growth during 2024-2033.

UK Education Market 2023–2032 (By Billion)

www.custommarketinsight.com

The Educational Services Segment is anticipated to witness a high UK Education Market

- Gamification techniques are being used in educational services to improve student learning. Gamification is the idea of using game design thinking to improve the enjoyment and engagement of various educational assignments.

- Gamification is fostering a comprehensive learning environment in educational services that raises students’ engagement, motivation, and critical thinking abilities.

- Many people think that the trend of using tablets and laptops in schools as part of the curriculum will only continue to spread. According to several studies, utilizing technology in the classroom can improve students’ learning outcomes. For instance, a researcher discovered that when students were given iPads to use in class, their test scores improved, and their attendance increased. Teachers and students alike embrace this trend since it provides a more participatory and captivating learning method.

Competitive Landscape

Our market analysis includes a section specifically devoted to key players operating in the UK Education market. Our analysts give an overview of each player’s financial statements, along with product benchmarking and SWOT analysis. The competitive landscape section includes key development strategies, market share analysis, and market positioning analysis of the mentioned competitors globally.

- 2023: A strategic alliance between New Era Education, New Giza Development, and Bloom UAE was announced today in order to bring one of the top schools in the United Kingdom (UK) to Cairo. One of the most prestigious and illustrious institutions in the UK, Uppingham School, will open Uppingham Cairo, a K–12 coeducational school, in September 2024.

HEY, I’M AUTHOR…

A seasoned college prep and admissions expert with 7 years of experience helping students navigate the complexities of the application process. Passionate about education and technology, Jonathan specializes in creating innovative strategies and tools to empower students to achieve their academic dreams. As a thought leader in the field, I'm dedicated to sharing insights on the latest trends in college prep and admissions.

JOIN MY MAILING LIST

DRCherry Tech

Have questions or need assistance?

We're here to help!

📧 Email: support@cherry.tech

📞 Phone: +1 (123) 456-7890

📍 Address: 123 Education Lane, Learning City, ED 45678

Stay Connected:

Follow us on social media for updates and announcements.

Let us know how we can support your educational journey!

Newsletter

Subscribe now to get daily updates.

Created with © systeme.io